First Wire of 2026. Fresh starts, compounding bets.

A new year. A clean slate. And if you're reading this, you're already thinking about your next moves.

Before we look ahead, let's take a beat. 2025 was the year this community became real—and we have the receipts.

20+ events. 2,500+ RSVPs. 10+ cities. These numbers don’t lie.

We didn't set out to host events. We set out to build a community worth showing up for. Turns out, when you get the right people in the room, things compound.

Thank you for being part of it. For the conversations, the conviction, and the connections that happened after the events ended.

2025 was year one. 2026 is where it scales.

Let's go.

TL;DR

→ Goodfin Futures returns with Yana Welinder—the founder who built Kraftful, sold it to Amplitude, and now invests as an a16z Scout. We're unpacking the founder-investor playbook.

→ Unlocking Private Markets goes live Jan 29 with Alto's CEO Eric Satz breaking down Self-Directed IRAs and alternative investments

→ Goodfin Gatherings Edition 2 got real—members shared 2AM ideas, what's shaping their thinking, and community-curated recommendations worth your time

→ Community Ticker report dropped—three months of data on what Goodfin members are betting on and why, from aerospace to quantum computing

→ AI News Digest is live—personalized pre-IPO intelligence, delivered every Monday

ON THE CALENDAR

Goodfin Gatherings: Edition 3

January 14th | 12 PM PT | Virtual

New year, new faces to meet.

Edition 3 kicks off 2026 with the kind of conversations you don't get in conference rooms or LinkedIn DMs. Investors, founders, operators—talking about the human side of what we do. No scripts, no structure, just people being real.

This time we're going deep on: The Bold Bet (one high-risk move you'd make on yourself or the world), What We're Missing (something from the past you actually miss), and Signal vs. Noise (how you decide what's worth paying attention to).

45 minutes. Whether you're starting the year with bold moves or still figuring things out, this is your space.

Goodfin Futures: The Founder-Investor Playbook with Yana Welinder

January 22th | 12 PM PT | Virtual

She built Kraftful to 50,000+ product teams. Sold it to Amplitude. Now she's Head of AI there—and an a16z Scout backing YC companies before anyone else.

Yana Welinder sits on both sides of the table. This fireside unpacks how founders who invest should think about deal flow, the signals that matter before a breakout, and what she learned selling a company in 2025.

We're going deep on the a16z scout framework, the Kraftful acquisition, and her approach to evaluating AI startups.

Goodfin Members Mixer: Culture Edition

January 23rd | 3 PM PT | In-person

Art, design, robotics, and the people building what comes next.

We're gathering at FOG DESIGN + ART Fair at Fort Mason for an afternoon that blends culture with conviction. The agenda: an intimate panel on building the future of design with Nahuel Battaglia (Senior Industrial Design Lead, Zoox) and Caitlin Kalinowski (Robotics, OpenAI). Then we explore the fair, meet leading gallerists, and continue the conversation over drinks.

Free for Premium & Reserve members. This is a members’ event—your information will be verified.

Unlocking Private Markets: Alternative Investments in Self-Directed IRAs

January 29th | 12 PM PT | Virtual

Eric Satz, Founder & CEO of Alto, breaks down how to access private market investments through retirement accounts. Beyond his work at Alto, Eric hosts The Altogether Show and previously served on the TVA Board under President Obama.

This session covers the latest trends, key considerations, and Q&A.

IN THE REARVIEW

2025: The Year We Showed Up

20+ events, 2,500+ members, 10+ cities later, here's the highlight reel.

We started with a question: What happens when you stop treating the community as a marketing channel and start treating it as the product?

The answer showed up in Mahjong nights, Hamptons yacht parties, and intimate dinners. In a pre-All-In brunch at an LA rooftop, Supper Clubs in NYC, closing out LA Tech Week in Venice and more. In a live Q&A with Derek Fisher. In a Member-led talk where our own community took the mic. In a fireside chat with Robert Scoble. In a tax strategy session that actually moved the needle, and Deal Rooms where names stayed off the record.

And in the quieter stuff—Coffee Chats, Gatherings, and events that quickly became memories.

And we are just getting started in 2026. It will be grand and epic.

Inspiring FinTech Female 2025

Our Founder and CEO Anna Joo Fee was named to NYC FinTech Women's Inspiring FinTech Females 2025 list, alongside an incredible group of women shaping the future of fintech.

Building diverse teams. Mentoring the next generation of women in fintech. Anna is just getting started.

Congrats to all the honorees celebrated at Nasdaq.

Goodfin Gatherings: Edition 2

45 minutes. No scripts. Real conversations.

Members showed up, stuck around for over an hour, and went deep on the prompts: 2AM ideas that still feel worth chasing. What they hope to have figured out in ten years. And the content that actually changed how they think.

What surfaced: Community Recommendations

The "content that hit different" prompt worked. Here's what members shared:

→ Outlive by Peter Attia—the definitive manual on extending lifespan while improving healthspan. Members called it required reading for anyone thinking long-term.

→ Nudge by Richard Thaler & Cass Sunstein—Nobel Prize-winning behavioral economics on how choice architecture shapes decisions. Relevant for investors, operators, and anyone building products.

→ The World for Sale by Javier Blas & Jack Farchy—a look inside the secretive world of commodity traders who supply the planet with oil, metals, and food. One member said it reads like a thriller.

→ Listers: A Glimpse Into Extreme Birdwatching—the viral YouTube documentary following two brothers on a year-long competitive birdwatching quest. Surprisingly gripping. Members couldn't stop talking about it.

WHAT'S NEW

Three months of conviction data, now public.

In Q4, we launched the Goodfin Investor Ticker—a feature that lets members share their conviction on live deals. Not just bullish or bearish, but why.

The result: a proprietary signal layer built by investors actually deploying capital.

We've synthesized the insights into our first Community Intelligence Report. What emerged: government contracts de-risk deals. Execution beats narrative. Valuation discipline persists even in bullish sectors.

AI News Digest is live

Our AI-powered news digest launched, and it's already becoming a Monday morning staple.

Goodfin AI Digest is a curated pre-IPO intelligence tailored to the companies in your sector focus—AI, robotics, space, defense, fintech, crypto, biotech. Our AI scans thousands of sources to surface the signal: funding rounds, market shifts, and the stories shaping private markets.

If you're not getting it yet, you're missing the signal.

FROM GOODFIN’s AI AGENT

The signal that matters surfaced for you. Here's what our AI pulled from the noise this week:

→ Anthropic's "do more with less" bet. While OpenAI commits $1.4T to compute and infrastructure, Anthropic is betting on efficiency. President Daniela Amodei argues the next phase won't be won by the biggest pre-training runs alone—but by who can deliver the most capability per dollar. With a possible 2026 IPO on the horizon and roughly $100B in compute commitments, it's brute-force scale versus algorithmic efficiency. The question: what happens to the AI arms race if the industry's favorite curve stops behaving? Read more

→ Palmer Luckey is ushering in a new age of defense tech. Anduril's founder is on a victory lap. Once a taboo corner of the business world, defense tech is now one of Silicon Valley's most competitive battlegrounds. The Trump administration is leaning into defense spending, drone warfare is creating openings for agile startups, and traditional contractors are racing to keep up. The Navy says a Palantir-powered AI system cut a 160-hour job to 10 minutes. Luckey's authenticity—and his willingness to stick to his positions—has made him the poster child for tech's new love affair with the military. Read more

We’ve got more signal waiting for you inside Goodfin. Sign in to the platform and never miss a beat.

A win for our community: Congratulations Groq Investors 🥂

NVIDIA's acquisition of Groq's assets is now official—a strong validation of the company's technology and trajectory. To every Goodfin member who invested in Groq through our platform: this one's for you. We're tracking payout details and will share updates as structure, timing, and amounts are confirmed.

MEMBER POLL

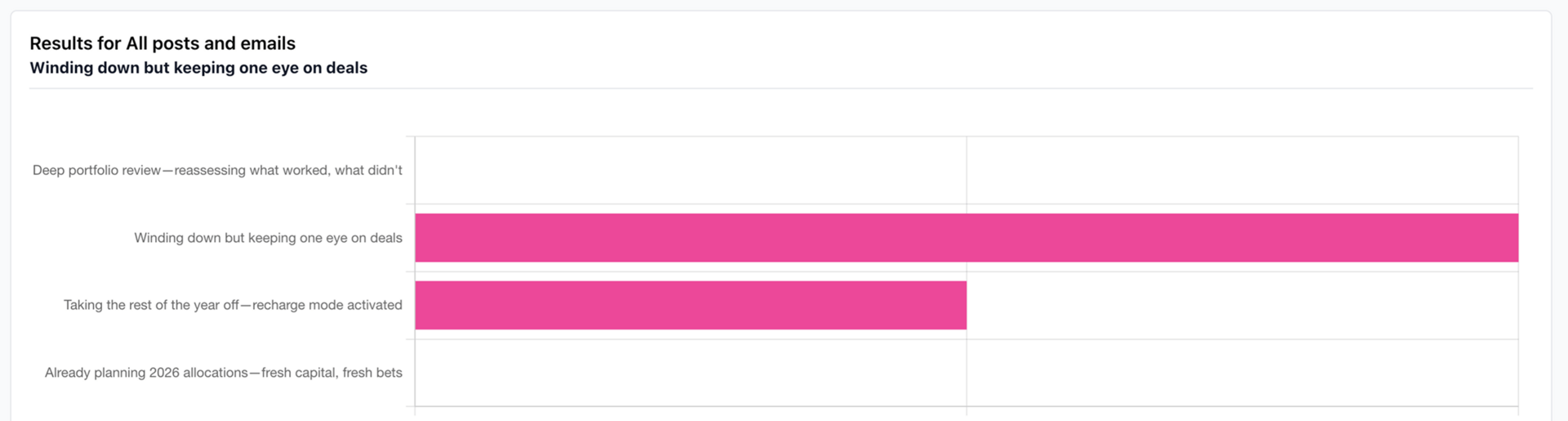

The last poll asked how you're closing out 2025. 67% said "Winding down but keeping one eye on deals"—followed by "recharge mode activated." This community doesn't fully disconnect.

Now let's look ahead now.

What's your boldest 2026 prediction?

Vote and you're automatically entered to win exclusive Goodfin merch. We'll randomly select voters and send you something special.

Goodfin | Your inside track to elite private markets